IR-News details

MTU Aero Engines presents business outlook for the next decade

- By 2024: rising EBIT margin and rising free cash flow

- 2015: significant growth in series production, moderate increase in spare parts

Munich, November 25, 2014 – At this year’s Investor & Analyst Day, MTU Aero Engines AG presented its business outlook for the next decade to 2024. The group aims to remain on its growth trajectory while at the same time continuing to improve its profitability. It plans to increase its adjusted EBIT margin and its free cash flow in the medium to long term. This goal is based on the expected development of revenues in its operating segments. As of 2018, MTU expects to see substantial growth in revenues from its most profitable activities, namely spare parts sales and maintenance. From this point onward, revenues from the less profitable series production business are likely to increase only slightly, and the military engine business will probably decline.

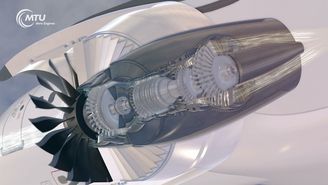

MTU is currently in a high capital expenditure phase that will continue through to 2017. The company nonetheless foresees a moderate increase in adjusted EBIT during this period. The stakes MTU has acquired in new engine programs secure it a favorable position in all sectors of the commercial aircraft market. As a result, growth will be far stronger in the series production and maintenance sectors than in the spare parts business. The military engine business will remain stable. “Our main focus in the next few years will be on ramping up production for the geared turbofan programs and further developing the relevant technologies. We are also working on R&D projects for engines that will play an important role in the future, such as the GE9X for the Boeing 777X. These projects have a tight schedule until their entry into service. In the MRO segment, we are strengthening our position in the OEMs’ maintenance networks,” said Reiner Winkler, CEO of MTU Aero Engines AG. “We will start to reap the benefit of these investments from 2018, when we expect growth rates in the high-margin areas of our business to accelerate.”

In 2015, MTU expects to achieve a high single-digit growth rate in revenues from its expanding series production business. A similar growth rate is anticipated in the commercial maintenance segment. The increase in revenues generated by spare parts sales is expected to lie in the mid-single-digit percentage range. The military engine business is expected to remain stable. MTU plans to issue a more detailed financial forecast at its annual results press conference on February 12, 2015.

MTU has made extensive investments to prepare for the production phase of the geared turbofan programs, which enjoy considerable market success. It has constructed a new production facility for geared turbofan components and a new logistics center in Munich, and expands its plant in Poland. With its stake in the GE9X program for the Boeing 777X, MTU will secure its share in the future market for long-haul airliners. “Despite these major investments, our cost optimization measures have had a positive impact on our free cash flow this year,” said Winkler. “Before deduction of acquisition costs, we are looking to achieve a free cash flow in the mid-double-digit range for 2014.”

Presentation Investor and Analyst Day 2014 (PDF)

About MTU Aero Engines

MTU Aero Engines is Germany's leading engine manufacturer and has been a key player in the global engine industry for 80 years. It engages in the development, manufacture, marketing and support of commercial and military aircraft engine modules and industrial gas turbines. The company is a technological leader in low-pressure turbines, high-pressure compressors, manufacturing processes and repair techniques. Figuring significantly among MTU's core competencies are the maintenance, repair and overhaul (MRO) of commercial engines and the service support it provides for industrial gas turbines. These activities are combined under the roof of MTU Maintenance, which is one of the world’s largest providers of commercial engine MRO services. MTU operates affiliates around the globe; Munich is home to its corporate headquarters.

Contact

Senior Manager Investor Relations

Senior Manager Investor Relations